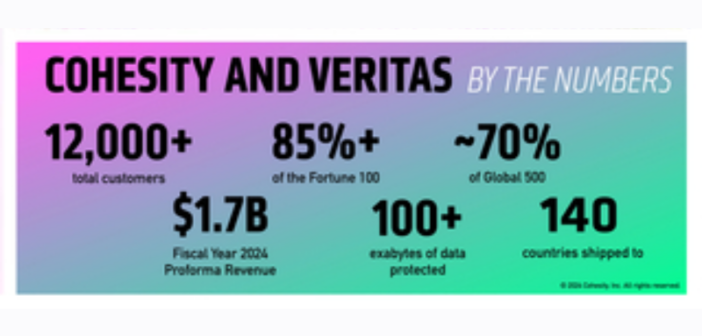

Cohesity has finalized its merger with Veritas’ enterprise data protection business, marking a new chapter in global data protection. Now the largest data protection software provider by market share (1), Cohesity supports over 12,000 customers, including more than 85 of the Fortune 100 and nearly 70% of the Global 500, safeguarding hundreds of exabytes of data worldwide. This merger enhances Cohesity’s offerings with the broadest workload support and one of the industry’s largest partner ecosystems.

Cohesity, now the largest data protection company, achieved $1.5 billion in revenue in just 11 years, making it the fastest in the industry to reach this milestone. On a pro forma adjusted basis for the fiscal year ending July 2024, the combined entity had revenue of over $1.7 billion, annual recurring revenue (ARR) of $1.5 billion, and a 28 percent adjusted cash EBITDA margin.

“This is a major milestone in the 11-year history of Cohesity, whose mission is to protect, secure, and provide insights into the world’s data,” said Sanjay Poonen, President and CEO, Cohesity. “By combining Cohesity’s scale-out architecture and strong generative AI and security capabilities with Veritas’ broad workload support and extensive global footprint, our customers and partners stand to gain more value from their data than ever. As promised, we will honor our “no customer left behind” commitment, supporting existing products from both companies for years to come. As we begin this new chapter, we are committed to driving industry-leading cyber resilience innovations to ensure we are the world’s preeminent choice for data security with differentiated AI capabilities.”

“We want to congratulate Cohesity on completing their Veritas acquisition. NVIDIA is excited to partner with Cohesity as they build their GenAI products on top of the NVIDIA AI Enterprise,” said Jensen Huang, founder and CEO of NVIDIA. “Cohesity is backing up and protecting the world’s data – a goldmine of business value that customers can unlock with GenAI.”

“Bringing together Cohesity and Veritas’ data protection business – the largest deal in the data protection space to date – addresses the growing need in the market to go beyond backing up and recovering data to handle issues around data security and insights for more robust cyber resilience,” said Daniel Newman, CEO, The Futurum Group. “Cohesity now has the largest workload support with world-class security and insight capabilities, a large presence, and a massive joint ecosystem of service providers, VARs, SI partners, and OEMs. Sitting in a unique position at the junction of multicloud, security, and AI, Cohesity is on an ambitious growth trajectory, with an experienced leader in Sanjay at the helm. We believe the company will be a key player as they expand beyond data protection, helping global CIOs exploit the potential for AI and turn organizational data into a competitive advantage.”

A New Era in Protecting the World’s Data: How the Combination Will Benefit Customers and Partners

The combination of Cohesity with Veritas’ data protection business provides:

- Industry-leading Innovation and Capabilities: The combined company will offer cloud-scale and AI-powered data security and management, Generative AI-driven insights, an easy-to-use management interface, and a comprehensive multicloud data protection portfolio. Cohesity now supports the broadest range of workloads within a highly scalable modern architecture.

- Peace of Mind for Current Customer Investments: For years to come, Cohesity will continue to invest in and advance the roadmap and strategy for all products brought from both companies into the new combined portfolio. This includes all existing Cohesity products and services and all the Veritas solutions covered by the combination agreement, including Veritas NetBackup, Veritas NetBackup appliances, and Veritas Alta data protection offerings.

- Global Scale and Support: With an industry-leading Net Promoter Score and a global go-to-market footprint, Cohesity now supports a combined global, “follow-the-sun” customer success organization. Cohesity is committed to helping enterprises succeed by consistently providing positive outcomes for customers’ support experience and needs.

- Advanced AI Capabilities: Patent-pending, first-to-market AI capabilities offer customers tremendous data management, protection, and resiliency benefits and help them gain more significant insights and create value for the whole company from their data.

- Strong Partner Ecosystem: The combined company brings together one of the industry’s largest partner ecosystems, covering cloud service providers, security players, VARs, system integrators, MSPs, technology ecosystem partners, distribution partners, and hardware OEMs.

Cohesity will target a total addressable market (TAM) of $40+ billion, which includes IDC’s data replication and protection software market. IDC’s’ Semiannual Software Tracker, 2024H1, estimates the data replication and protection software market to be $12.3 billion in projected vendor sales in 2024(2). The expanded go-to-market breadth, geographic footprint, and R&D resources will allow the combined company to accelerate new customer adoption and help drive the deployment of innovative solutions within the fast-growing data security and management segment. The transaction values the combined company at over $7 billion.

Transaction Details and Advisors

The combined company received support from current marquee investors, including Sequoia Capital, Softbank Vision Fund I, Wing Venture Capital, Premji Invest, and Madrona. The Carlyle Group, through its ownership of Veritas, is now one of the largest shareholders in the combined company.

The transaction was funded by a Series H investment round led by Haveli Investments, which provided the majority of equity in the transaction and is now one of Cohesity’s largest shareholders. Coatue, Sapphire Ventures, and Dragon Fund were also key investors in the Series H investment round. This robust backing ensures the financial and operating resources essential for propelling the company’s growth, extending its global presence, and driving continued product innovation.

“We are thrilled to lead Cohesity’s latest investment round to fund this transformative transaction,” said Brian Sheth, CIO of Haveli Investments. “This combination creates a new data protection and cyber-resiliency powerhouse. We expect the resulting scale and combined resources to accelerate product innovation, extending Cohesity’s product leadership. I look forward to serving on Cohesity’s Board of Directors and working closely with Sanjay and the management team as we focus on taking Cohesity’s business to a new level of success.”

A complete listing of Cohesity’s leadership team, including the company’s Board of Directors, can be found at the website here.

J.P. Morgan Securities LLC served as Cohesity’s exclusive M&A financial advisor, and JPMorgan Chase Bank, N.A., arranged and committed financing for the transaction. BofA Securities, Inc. also served as financial advisor to Cohesity. Simpson Thacher and Bartlett LLP and Gunderson Dettmer LLP served as primary legal advisors to Cohesity. Guggenheim Securities and Morgan Stanley & Co. LLC acted as financial advisors to Veritas. Alston & Bird LLP, Latham & Watkins LLP, and Wachtell, Lipton, Rosen & Katz served as Veritas’ primary legal advisors for the transaction.

To learn more about Cohesity’s merger with Veritas creating the largest data protection software provider, visit the website here.

Related News:

Cohesity Announces New AI Enhancements for Visual Data Explorer

Cohesity Integrates with Crowdstrike to Level the Playing Field

(1) Based on industry analyst and internal data

(2) IDC’s Semiannual Software Tracker, 2024H1, Nov. 2024